What is a FICO® Credit Score and Why Should You Care?

10/18/2021

2 min. read

By: FCU Team

If you’ve ever applied for a loan, you know about the value that financial institutions place on your credit score. While far from the only factor that is evaluated, your credit score provides lenders with quick insight into your financial history. A credit score is derived from your credit report, which you can think of as your history with credit: your payment history, how long you’ve had credit, your utilization and much more.

Is There a Difference Between a FICO® Score and Other Credit Scores?

Yes and no. There are many kinds of credit score variants, and FICO® is just one of them. All you need to know is that each score is used for the same reason as above: to give an idea to lenders about your credit history. What sets FICO® Scores apart from all other credit scores is that FICO® has become the most widely used score type by financial institutions. The score ranges from 300 to 850, with a few different kinds of score variants that FICO® themselves offer. FLCU offers the FICO® Score 9. The reason you may have different credit scores with different companies is that each one calculates it in their own way. The name “FICO®” comes from Fair Isaac Corporation, the original name for the company.

The Importance of FICO® Scores

As mentioned above, the FICO® Score is a measure of your creditworthiness, a way to see how likely you are to repay your debts. The higher your score, the less risk there is for potential lenders. Less risk can equal lower interest rates on loans and more savings for you in the end. It’s in your best interest to check your score on a regular basis and make financial adjustments to bring it up!

To illustrate this point, we hopped over to the “Calculate a Vehicle Payment” calculator on our website. Please note that this is purely a hypothetical exercise and should not serve as an example of our lending practices.

Let’s say you’re going to be purchasing a $30,000 vehicle, $31,900 total with a sales tax rate of 8%. Your down payment is $3,000, bringing the total loan amount to $29,400 for your shiny new car.

At a 5% interest rate on a 60-month loan term, you’re looking at monthly payment of $554.81. The total amount you’d pay by the end of the term is $32,288.60.

At a 10% interest rate on the same term, the payment rises to $624.66. The total amount you’d pay by the end of the term is $37,479.60.

This exercise shows us that the difference between someone whose score lands them a 5% interest rate versus someone whose score qualifies them for 10%. The difference comes out to the tune of $5,191 for the scenario we’ve presented.

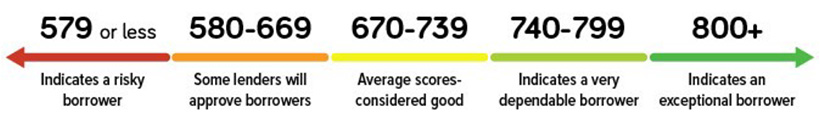

Finally, the diagram below demonstrates how financial institutions might see you based on your FICO® Score.

Factors Affecting Your Credit Score

There are five score factors, and each has an impact on your score. You can learn about each one and the weight each carries with our credit score educational video below.

- Payment History (35%)

- Credit Utilization/Capacity (30%)

- Length of Credit History (15%)

- New Credit (10%)

- Types of Credit (10%)

When you check your FICO® Score, you’ll see a section that goes over a couple of score factors. The image below highlights what they look like within FCU Anywhere, our online and mobile banking platform. Be sure to take the time to research these whenever you see your score, as they provide a good starting point for score improvement.

.jpg)

Check Your Score!

Checking your FICO® Score has never been easier. Earlier this year, Florida Credit Union added the FICO® Score widget within FCU Anywhere. With monthly updates and score factors, this widget provides our members with the ability to be informed about their score and what they can do to see it improve. FCU members are also entitled to a free credit report analysis. Be sure to call or stop by your closest branch and take advantage of this free service!