Line Or Loan? Which Personal Loan Option Is Right For You?

1/8/2019

4 min. read

By: FCU Team

When it comes to borrowing money, you have quite a few options. While everyone is familiar with more common loan types such as short-term loans, personal loans and credit cards , they each have pitfalls you’ll want to avoid if you can.

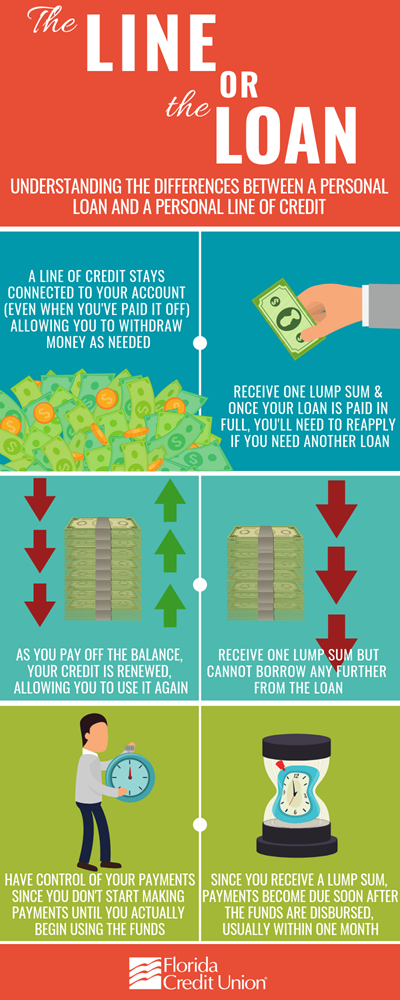

Shorter-term loans, as their name would suggest, require repayment within a short period. While personal loans give you an extended period for repayment, payments are due soon after the loan is disbursed. Even credit cards, the most popular option, come with high interest rates that can become costly over time and make debt easy to accumulate. If you’re looking for a loan that’s available when you need it and doesn’t require a payment when you don’t, a personal line of credit may be right for you.

Shorter-term loans, as their name would suggest, require repayment within a short period. While personal loans give you an extended period for repayment, payments are due soon after the loan is disbursed. Even credit cards, the most popular option, come with high interest rates that can become costly over time and make debt easy to accumulate. If you’re looking for a loan that’s available when you need it and doesn’t require a payment when you don’t, a personal line of credit may be right for you.

Most people are aware that if you own a home, you may have the option of using the equity from your home as a line of credit. But did you know you can also qualify for a line of credit, even if you don’t own your home? Personal lines of credit work a lot like a credit card. However, instead of paying fees to advance cash from your credit card, a line of credit allows you to withdraw money as you need it, at a consistent rate. And as you pay off the principal, your credit is renewed, allowing you to use it again! Why should you have a line of credit? Read on to find out about the benefits!

Only Pay For What You Borrow:

As opposed to a personal loan, a line of credit only requires payment when you utilize the loan. That’s right, you don’t make any payments until you actually use your line of credit! While credit cards are a similar option, some cards come with fees that may accrue even if you’re not actively using the card, like minimum interest charges and annual membership fees. Once a personal loan has been paid in full, the loan is closed and in order to have access to funds you are required to reapply. This is not the case with a line of credit. When your balance is paid in full, your loan remains attached to your Florida Credit Union account, ready to use whenever you need or want. No loan application, no credit pull, no questions asked.

Emergency Fund:

When most people apply for a loan, it’s because they need it, RIGHT THEN. Why not have it readily available WHENEVER you need it. Save yourself the hassle of going through the loan process when an emergency arises.

How does that saying go? If you stay prepared, you don’t have to get prepared! And since your line of credit can be accessed directly from your mobile app and online banking, FCU makes it easy for you to get access to the money you need, whenever you need it.

Overdraft Protection:

Reportedly, more than half of Americans have less than $1,000 to their name. And even if you're one of the few that does keep money in your savings to cover overages from your checking account, did you know that there are federal regulations that may prevent your overdraft from being covered? Regulation D limits the amount of electronic withdrawals from personal savings accounts, to six each month. So if you’ve met (or exceeded) that amount when an overdraft rolls around, your financial institution won't be able automatically transfer the funds to cover it. A line of credit could be the extra line of defense that you need. Instead of paying overdraft fees and other potential associated costs, your transaction could be covered by your line of credit.

Your Options:

So, whether you're just looking to cover a checking miscalculation, or need fast access to funds due to an emergency, a personal line of credit is a great safety net to have on standby. Florida Credit Union offers personal lines of credit with competitive rates, ask us about how a line of credit could work for you!